The Reserve Bank of Australia (RBA) has left the cash rate on hold at the historically low level of 0.10 per cent. Read today’s official statement on the RBA’s website.

Despite some speculation that a rise could be coming as early as mid-next year, RBA Governor Philip Lowe recently said the latest data and forecasts did not “warrant an increase in the cash rate in 2022”.

Despite the RBA holding firm, some lenders have hiked interest rates in recent weeks. If you’ve had your mortgage for a while, now is the time to check it’s still competitive. Talk to Fornaro to compare.

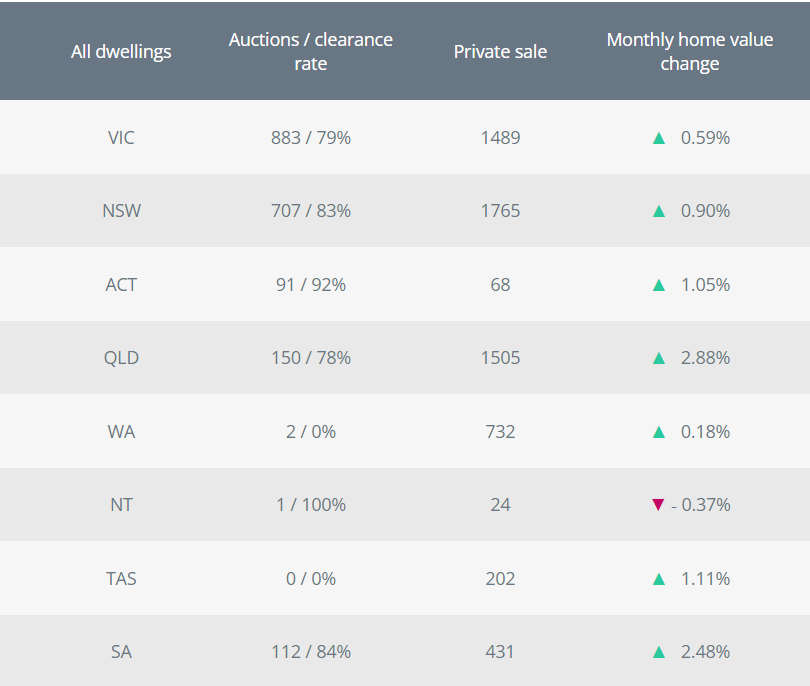

| Property market snapshot |

| Monthly Home Values figures as of 30 November, 2021. Australian auction results, clearance rates and recent sales for the week ending 5 December, 2021. The clearance rate is preliminary and current as of 09:37 am AEDT, 6 December, 2021. We recommend that you seek independent financial and taxation advice before acting on any information in this email. It contains general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances. Your full financial situation will need to be reviewed prior to acceptance of any offer or product. Interest rates are subject to change without notice. Lenders terms, conditions, fees and charges apply. Sources: CoreLogic RP Data Daily Home Value Index: Monthly Values, www.realestate.com.au, Minutes of the Monetary Policy Meeting of the Reserve Bank Board, Statement by Philip Lowe, Governor: Monetary Policy Decision |