The Reserve Bank of Australia (RBA) has kept the official cash rate unchanged at 0.25 per cent at its meeting on the 1 September. It also decided to expand the Term Funding Facility and make the facility available for longer.

RBA governor Philip Lowe announced at the meeting that unemployment and underemployment remain high. Based on the Bank’s central scenario, unemployment will rise to around 10 per cent later in 2020 and is expected to decline gradually to around 7 per cent in two years’ time. With this outlook, the RBA reiterated that it will not increase the cash rate until Australia is on its way back towards full employment and inflation is sustainably within the 2-3 per cent target band.

Housing values recorded a 0.4% fall in August on its fourth month decline due to the impact of COVID-19. However, the rate of decline has eased over the past two months and five of the eight capitals recorded steady or rising values through the month.

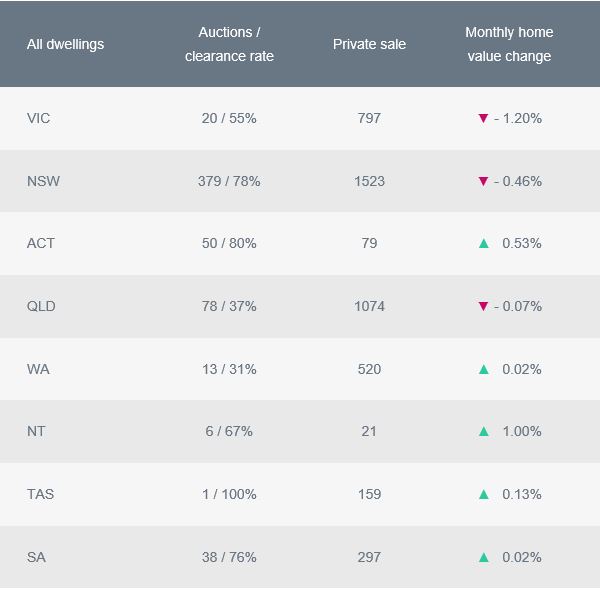

In the Home Value Index report from CoreLogic, Melbourne’s housing market, again, has posted the largest fall over the month, down at -1.20% in August. The rest of the capital cities all performed better as compared to the previous month. The decline in home values has eased down in Sydney (-0.46%) and Brisbane (-0.07%) while Canberra (+0.53%) and Adelaide (+0.02%) remained firm. Home values rose in Perth (+0.02%), Hobart (+0.13%), and Darwin (+1.00%). Tim Lawless, CoreLogic’s head of research, said “The performance of housing markets are intrinsically linked with the extent of social distancing policies and border closures which also have a direct effect on labour market conditions and sentiment. It’s not surprising to see Melbourne as the weakest housing market considering the extent of the virus outbreak, and subsequent restrictions, which have weakened the economic performance of Victoria.”

* Monthly Home Values figures as at August 31, 2020

* Australian auction results, clearance rates and recent sales for the week ending August 30, 2020. The clearance rate is preliminary and current as at 10:35 am, August 31, 2020.

Decreased housing values and record low interest rates means greater affordability for property buyers this Spring. Whether you’re looking for a place to live in or wanting to dabble in the world of property investment, speak to us about organising your finance and pre-approval on a home loan. This will put you in a great position to negotiate on the property you want. Get in touch today so we can get it sorted!

Interest rates are expected to remain low for a while, so now could be the time to secure the property you want.

To ensure you’re in a strong position to negotiate throughout the Spring season, be sure to speak to Fornaro today about your finance application.

Additional Sources:

https://www.rba.gov.au/media-releases/2020/mr-20-20.html

https://www.rba.gov.au/mkt-operations/announcements/increase-and-extension-to-further-support-the-australian-economy.html

https://www.realestate.com.au/news/interest-rates-on-hold-as-real-estate-market-braces-for-spring-selling-season/

This article is for general information only.